The private equity (PE) industry is characterized by complex deals, intricate relationships, and vast amounts of data. Managing this effectively requires a robust and specialized CRM system. This guide delves into the world of private equity CRM software, exploring its features, benefits, selection criteria, and frequently asked questions.

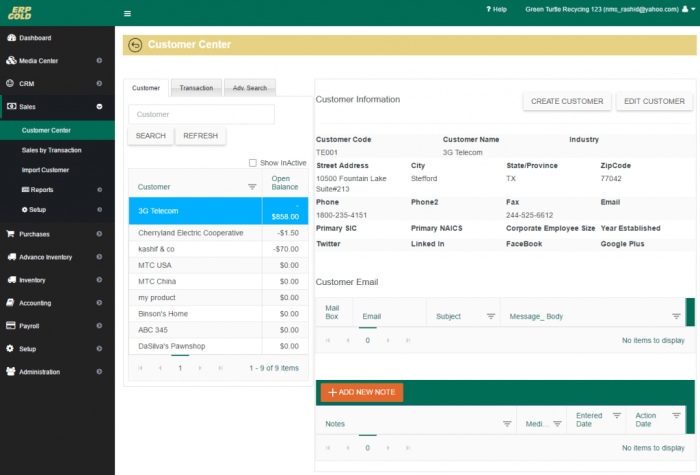

Source: erp.gold

Understanding the Needs of Private Equity Firms: Private Equity Crm Software

Private equity firms have unique requirements that go beyond the capabilities of standard CRM solutions. Their needs include:

- Deal Management: Tracking deal flow, from sourcing to closing, including due diligence, valuation, and legal documentation.

- Relationship Management: Maintaining strong relationships with Limited Partners (LPs), portfolio companies, and other stakeholders.

- Portfolio Management: Monitoring the performance of investments, tracking key metrics, and facilitating communication with portfolio company management.

- Reporting and Analytics: Generating comprehensive reports on investment performance, fundraising activities, and other key metrics.

- Security and Compliance: Ensuring the security and confidentiality of sensitive data, complying with regulatory requirements.

- Integration: Seamless integration with other critical systems, such as financial reporting software and email platforms.

Key Features of Private Equity CRM Software

Top-tier private equity CRM software offers a range of features designed to address these specific needs. These features typically include:

Deal Management Capabilities

- Deal Pipeline Management: Visual representation of the deal pipeline, allowing for efficient tracking of deals at various stages.

- Due Diligence Management: Centralized repository for due diligence documents, facilitating collaboration and efficient review processes.

- Valuation Modeling: Integration with valuation models to support accurate deal valuation and analysis.

- Document Management: Secure storage and management of all deal-related documents.

- Automated Workflows: Streamlining repetitive tasks, such as sending email notifications and updating deal statuses.

Relationship Management Tools

- Contact Management: Detailed profiles of LPs, portfolio company executives, and other key stakeholders.

- Communication Tracking: Logging all communication with stakeholders, ensuring transparency and accountability.

- Interaction History: Comprehensive view of past interactions, providing valuable context for future engagements.

- Relationship Mapping: Visual representation of relationships between stakeholders, identifying key influencers and connections.

Portfolio Management Functionality, Private equity crm software

- Performance Tracking: Monitoring key performance indicators (KPIs) of portfolio companies, such as revenue, profitability, and market share.

- Financial Reporting: Generating comprehensive financial reports on portfolio company performance.

- Board Portal Integration: Seamless integration with board portals for efficient communication and document sharing.

- Capital Call Management: Streamlining the process of managing capital calls from LPs.

Reporting and Analytics

- Customizable Dashboards: Providing real-time insights into key performance indicators.

- Advanced Reporting: Generating detailed reports on investment performance, fundraising activities, and other key metrics.

- Data Visualization: Presenting data in a clear and concise manner, facilitating informed decision-making.

Selecting the Right Private Equity CRM Software

Choosing the right CRM software requires careful consideration of several factors:

- Firm Size and Complexity: The size and complexity of your firm will influence the features and functionality you require.

- Budget: Consider the cost of the software, including licensing fees, implementation costs, and ongoing maintenance.

- Integration Capabilities: Ensure the software integrates seamlessly with your existing systems.

- User-Friendliness: The software should be intuitive and easy to use for all team members.

- Scalability: The software should be able to scale with your firm’s growth.

- Security and Compliance: The software should meet all relevant security and compliance requirements.

Top Private Equity CRM Software Solutions

(Note: Specific software names are omitted to avoid bias and ensure the information remains current and accurate. Researching current market leaders is recommended.)

Many vendors offer specialized solutions. When researching, look for those specifically designed for the unique needs of private equity firms. Consider requesting demos and comparing features before making a decision.

Frequently Asked Questions (FAQ)

- Q: What is the average cost of private equity CRM software? A: The cost varies significantly depending on the features, the number of users, and the vendor. Expect a range from several thousand to tens of thousands of dollars annually.

- Q: How long does it take to implement private equity CRM software? A: Implementation time can range from a few weeks to several months, depending on the complexity of the software and the firm’s requirements.

- Q: What are the key benefits of using private equity CRM software? A: Key benefits include improved deal flow management, enhanced relationship management, better portfolio management, improved reporting and analytics, and increased efficiency and productivity.

- Q: Can private equity CRM software integrate with other systems? A: Yes, many private equity CRM software solutions offer integration with other critical systems, such as financial reporting software and email platforms.

- Q: Is private equity CRM software secure? A: Reputable vendors prioritize security and compliance, employing robust security measures to protect sensitive data.

Conclusion

Investing in the right private equity CRM software is crucial for success in today’s competitive market. By carefully considering your firm’s specific needs and evaluating available solutions, you can significantly improve efficiency, enhance decision-making, and ultimately drive better investment outcomes. Remember to thoroughly research vendors and request demos before making a final decision.

Call to Action

Ready to streamline your private equity operations? Contact us today to discuss your specific needs and explore how the right CRM solution can transform your business.

Detailed FAQs

What are the key features to look for in private equity CRM software?

Source: founderjar.com

Key features include deal tracking, investor relationship management (IRM), portfolio company management, financial modeling integration, reporting and analytics dashboards, and robust security features.

How much does private equity CRM software typically cost?

Pricing varies significantly based on the size of the firm, the number of users, and the specific features included. Expect a range from several thousand dollars annually to tens of thousands, potentially more for highly customized enterprise solutions.

What is the best way to integrate private equity CRM software with existing systems?

Source: lenderkit.com

The best approach involves working with a vendor who offers seamless integration with your existing financial systems, such as accounting software and portfolio management platforms. API integrations and data migration services are crucial aspects to consider.

How can I ensure data security with private equity CRM software?

Prioritize vendors with robust security measures, including data encryption, access controls, and compliance with relevant regulations like GDPR and SOC 2. Regular security audits and updates are also essential.