Sales & use tax software – Sales and use tax (S&UT) is a complex area of taxation, and managing it effectively is crucial for any business operating in multiple jurisdictions. This guide dives deep into sales and use tax software, explaining its importance, features, benefits, and how to choose the right solution for your needs. We’ll cover various aspects, from the basics of S&UT to advanced features and best practices.

Source: acquireconvert.com

This article is designed to be a comprehensive resource for businesses of all sizes.

Source: rahulogy.com

Understanding Sales and Use Tax

Sales tax is a tax levied on the sale of goods and services. Use tax, on the other hand, is a tax levied on the use, storage, or consumption of tangible personal property. Both are crucial for businesses, and failing to comply can lead to significant penalties. Understanding the nuances of these taxes, and how they apply to your specific business operations, is essential for accuracy and compliance.

Key Differences Between Sales and Use Tax

- Sales Tax: Collected at the point of sale.

- Use Tax: Collected when a customer purchases goods or services that are not subject to sales tax in the state of purchase.

- Jurisdictional Variations: Rates and rules differ significantly by state and locality, making it challenging to manage without specialized software.

The Role of Sales and Use Tax Software

Sales and use tax software streamlines the process of calculating, collecting, and remitting taxes. It’s an essential tool for businesses operating across multiple states or with complex tax structures. Sophisticated solutions often integrate with accounting systems, providing a unified view of financial data and reducing the risk of errors.

Source: salestaxdatalink.com

Key Features of Effective S&UT Software

- Tax Rate Management: Accurate and up-to-date tax rate information is critical for compliance.

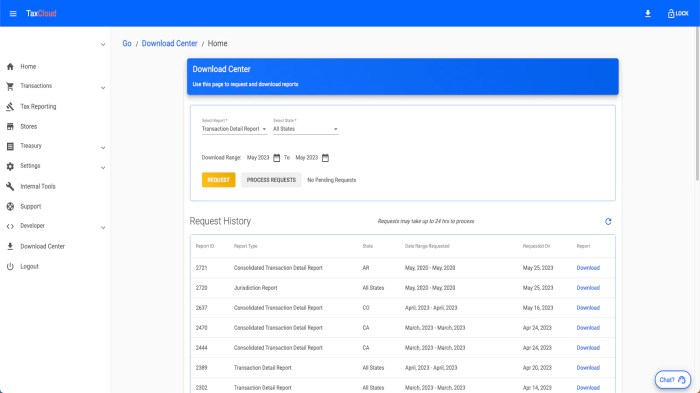

- Transaction Tracking: Detailed records of sales and use transactions, including applicable tax amounts.

- Reporting and Analysis: Generating reports for various tax jurisdictions, tracking sales trends, and identifying potential issues.

- Compliance Tools: Assistance with filing deadlines, and reminders for compliance.

- Integration with Accounting Software: Seamless data transfer for accurate financial records.

Choosing the Right Sales and Use Tax Software

Several factors influence the choice of S&UT software. Consider the size and complexity of your business, the number of jurisdictions you operate in, and your budget. Also, consider factors like user-friendliness, scalability, and customer support.

Factors to Consider When Evaluating Software

- Ease of Use: Intuitive interface for efficient data entry and reporting.

- Scalability: Ability to accommodate future growth and increasing sales volume.

- Customer Support: Availability of help and guidance during the implementation and operation phases.

- Customization Options: Tailoring the software to meet specific business needs and processes.

Benefits of Using Sales and Use Tax Software: Sales & Use Tax Software

Implementing sales and use tax software offers numerous benefits, including increased accuracy, reduced compliance risks, and optimized tax efficiency. This leads to substantial cost savings and greater financial control.

Improved Efficiency and Cost Savings

- Reduced Manual Errors: Minimizing mistakes in tax calculation and reporting.

- Automated Compliance: Meeting filing deadlines and reducing the risk of penalties.

- Streamlined Tax Reporting: Creating accurate and timely reports for all jurisdictions.

Common Mistakes to Avoid

Failing to stay up-to-date with changing tax laws and regulations can lead to costly errors and penalties. Inaccurate tax calculations, missed filing deadlines, and insufficient record-keeping are common pitfalls.

Addressing Potential Challenges, Sales & use tax software

- Jurisdictional Updates: Regularly reviewing and updating tax rules to ensure compliance.

- Accurate Data Entry: Ensuring accurate data entry to avoid errors in tax calculations.

- Proper Record Keeping: Maintaining detailed records of all sales and use transactions.

Frequently Asked Questions (FAQ)

- Q: How much does sales and use tax software cost?

A: Pricing varies significantly depending on the features, functionalities, and the vendor. Contact vendors for pricing information.

- Q: What is the best sales and use tax software for my business?

A: The ideal choice depends on factors like your business size, the number of jurisdictions you operate in, and your budget.

- Q: Can sales and use tax software integrate with my existing accounting system?

A: Yes, most modern sales and use tax software solutions integrate with popular accounting systems, providing seamless data transfer.

- Q: How can I ensure compliance with sales and use tax laws?

A: Stay informed about changes in tax regulations, maintain accurate records, and utilize compliant software.

Conclusion

Sales and use tax software is an invaluable asset for businesses operating in multiple jurisdictions. It enhances compliance, streamlines operations, and improves accuracy, ultimately leading to significant cost savings and reduced risk. By understanding the features, benefits, and potential challenges, businesses can make informed decisions about selecting and implementing the right solution for their specific needs.

Call to Action

Ready to streamline your sales and use tax processes? Contact us today for a free consultation and explore how our sales and use tax software can help your business thrive.

Disclaimer: This article is for informational purposes only and should not be considered professional tax advice. Consult with a qualified tax professional for personalized guidance.

References: [Insert links to reliable sources on sales and use tax, like IRS, state tax agencies, etc.]

FAQ Compilation

What are the common types of sales & use tax software available?

Different types of software cater to varying business needs. Some are cloud-based, offering flexibility and accessibility, while others are on-premise solutions, providing more control. Consider factors like business size, industry, and complexity when choosing the right software.

How can I determine if this software is right for my business?

Assess your current tax processes and identify pain points. Consider factors like the number of transactions, the variety of jurisdictions, and the complexity of your tax calculations. Evaluate if the software’s features and capabilities meet your specific requirements.

Are there any hidden costs associated with this software?

While the core software often has a subscription fee, be mindful of additional costs such as training, technical support, or integration fees with existing accounting systems. Check the pricing structure thoroughly before committing.